“The most important thing in communication is hearing what isn’t said.”

– Peter Drucker

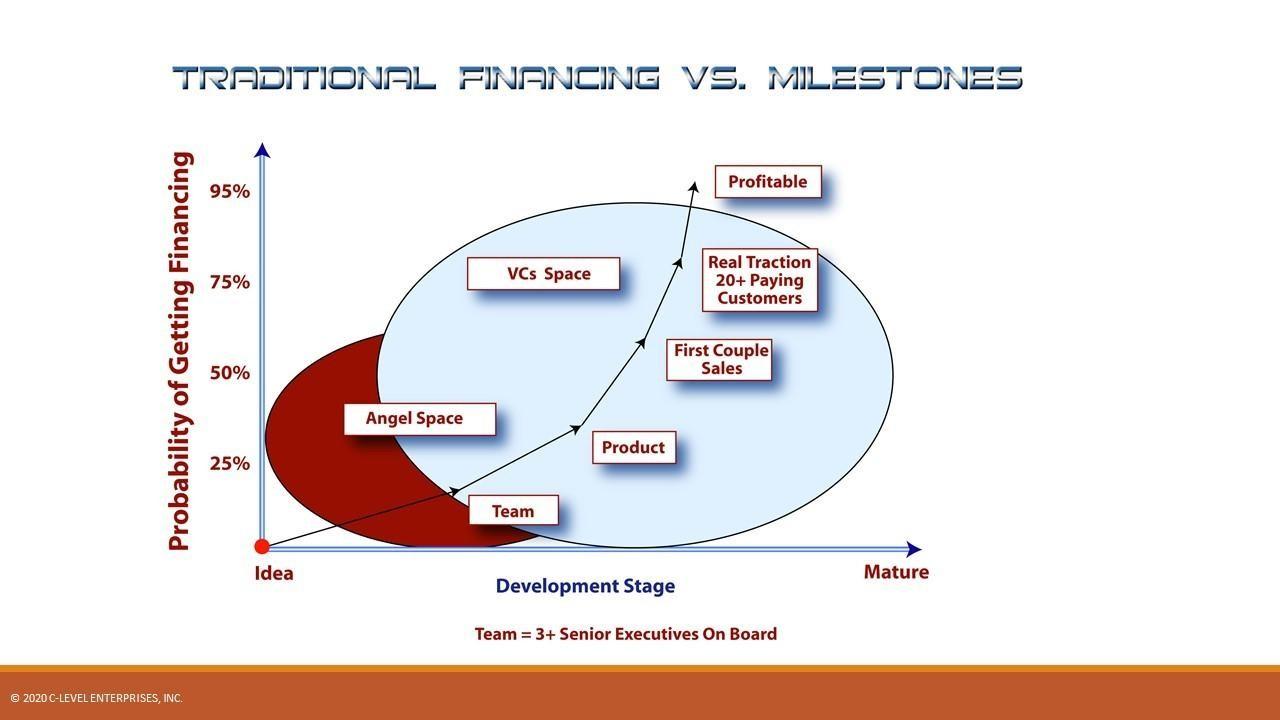

The financing landscape has undergone significant changes, providing a wide range of options from seed to Series F stages. However, securing equity financing has become more challenging again now in 2023, making it crucial to adapt to the evolving environment. The current situation resembles the early 1990s, where everyone has “moved up the food chain” by one to two levels.

Series A financings that are most often $5M to $10M (non-unicorns) that solely fund product development are now very rare, with institutional investments predominantly reserved for companies with proven traction, meaning substantial sales have been achieved. Angels may fund product development, but many expect the founders and friends and family to fund the prototype product. For SaaS companies traction is usually at least $1M Annual Recurring Revenue (ARR).

A couple decades ago, companies typically went through two financing rounds before reaching this stage, allowing them to develop the product and test sales and marketing processes. Now, entrepreneurs must achieve more with less capital, which may require incorporating a low-cost market entry strategy, like social media, or seeking corporate partnerships, or employing other low-cost marketing strategies.

Fortunately, certain aspects such as software and hardware development have become more efficient, enabling the development of phone apps for less than $20,000. However, larger products requiring extensive research and development may still require millions to develop. Adopting a Minimum Viable Product (MVP) approach is often necessary, but it’s essential to remember that if you can do it cheap, someone else can too, reducing the barriers to entry. A double-edged sword.

To succeed, companies must design their business plans to align with these conditions. Launch strategies can be fine-tuned to require less capital, aiming to reach a breakeven level faster and meet specific milestones at the right time. Early-stage capital has become increasingly difficult to obtain, potentially involving equity sacrifices or even unavailability for certain stage companies. See the link to the replay of my webinar on raising capital below.

This creates a significant gap in what used to be expansion financing during Series B, C, and D rounds. However, once a profitable formula is established, raising larger sums of money becomes easier, making seed and Series A funding the most challenging to secure. At that point, valuations tend to be low, resulting in a substantial equity stake, and dilution. Failing to plan ahead can cause many companies to fall into this chasm. It is crucial to have a capital raising plan for the next two to five years, including multiple steps and rounds. This is really the “bait” for investors showing that you did your homework and understand how to step up the stock price with each milestone achieved and financing round.

The financing environment is akin to the weather for a company’s picnic. It cannot be changed, so plans must be adjusted accordingly, taking into account the current circumstances. Many great companies and ideas will fail simply because they lack a feasible capital path in today’s environment. Capital is oxygen for any startup.

Learn more about our Growth and Scaling (GSP) Certification program for Managers, click here

The Traditional Financing Lifecycle

In this different world, numerous promising companies find themselves in the precarious position that was once filled by “Series A to Series B stage” financing rounds, typically in the $1.5 million to $5 million range. Angel investors are generally unable to cover this gap, and venture capitalists are less active in this space. However, angel syndicates have stepped in, providing funding up to $2 million, while super angels capable of investing $500,000 to $5 million each cover some of the area previously filled by VCs. However, to attract capital at this stage you must have:

- A differentiated product or service, not a commodity

- A large market opportunity (TAM) of $1 billion plus around 5 years out

- A quality team with three top people, typically the CEO, VP of Product/CTO and the CMO/VP of Marketing. These are the hardest challenges and people to find.

If you do not have all of these, you need to go back and rethink your financing strategy as you will invest a lot of time learning you cannot raise the capital needed yet.

“Plans are only good intentions unless they immediately degenerate into hard work.”

– Peter Drucker

Bottom Line: You NEED to adjust your business plan in major ways to account for many factors! And it will be very dependent on the short-term environment. Timing is important. This is not being deceptive, or crunching numbers more optimistically. It is changing your target market, steps into those markets, product offering and/or pricing. And possibly more.

A real financing strategy maps out three to five years of financing in a plan showing major milestone achievement, and how they may increase the valuation of the company, making subsequent rounds easier at a 2X or more increase in stock price. This is built into a 5-year simulator spreadsheet, going beyond a standard pro forma an accountant would do, and used for scenario analysis and capital raising plans. We call this Strategic Budgeting, or innovation budgeting. Accountants cannot do this. It is the responsibility of the CEO. In my experience only a small fraction of CFO know how to do this well too. Their skills set and personality is not risk taking, new product development and visions.

Developing a financing strategy requires experience and an understanding of the current financing landscape. It is best to get a professional involved to develop this. However, many professionals only specialize in certain financing sources and stages. As of about 2019, crowdfunding has emerged as a source of funding for many early-stage companies. We have courses and webinars with more in-depth information on raising financing, as it is a big area with dozens of categories of other capital sources.

For a free video consultation, call on what your company and team need to scale better, click here

In conclusion, it is imperative to make major adjustments to your business plan, considering various factors and adapting to the current financing landscape. Timing plays a crucial role, and a well-developed financing strategy that spans three to five years, highlighting major milestones and their potential impact on valuation, can make subsequent rounds easier to secure. Of course, being in hot spaces, like AI now, does not hurt either. Can you incorporate AI techniques into your product? Most probably can.

Crowdfunding has emerged as a funding source for early-stage companies since around 2019, and we have several courses and webinars available for more in-depth information on raising financing, as this is a vast area with numerous funding sources to explore. See link below.

“Effective leadership is not about making speeches or being liked; leadership is defined by results, not attributes.”

– Peter Drucker

Free Webinar Replay

How to Raise Millions from Outside Investors for any Company – Learn the 30 other sources of capital beyond angel and VC and how to prepare a company and get it into the top few percent investors see.

Mr. Norton offers a flat rate consultation session on financing to help young companies identify what they don’t know yet and get their company ready. Save yourself a year or two of struggle and spend a few hundred on this. It could even be the difference between survival and bankruptcy.

Most young companies jump in much too early, ruining their chances with the first contacts. Not only is this a waste of time and effort, but it shuts down your best contacts early and prevents you from getting to other investors those would refer you to if you presented well.

The most common mistake entrepreneurs make raising angel money today is going out to their best networking contacts before they are ready. They burn their best chances for money and other contacts in the chain. Your deck, business model and team needs to be vetted by an experienced CEO and entrepreneurs that has raised funding before.