“Every great achiever is inspired by a great mentor.” – Lailah Gifty Akita

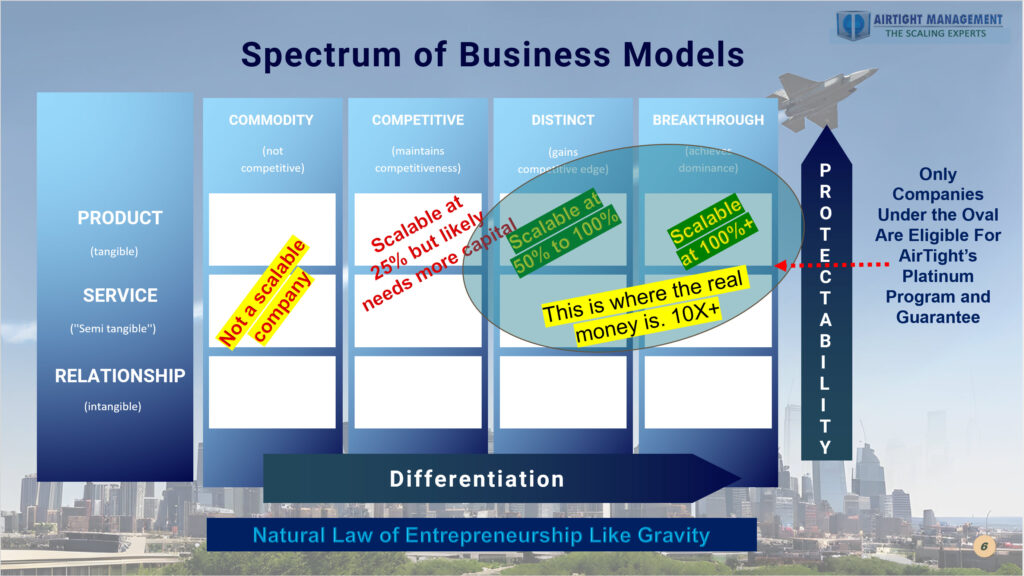

Scalability is a crucial concept in business, but not all companies are created equal in this regard. Some are inherently more scalable than others, and understanding why can help entrepreneurs make wiser choices. In this article, we’ll explore the kinds of companies that are most scalable and why they hold this advantage.

1. Product vs. Service Companies: In the world of business, two primary company types emerge: product companies and service companies. Generally, product companies tend to be more scalable. The reasons for this are twofold. First, scaling a tangible product is often more straightforward than scaling a service. Second, products can be protected with barriers to entry, making it harder for competitors to copy your success.

2. The Challenge of Service Companies: Service companies face a unique challenge when it comes to scalability. This challenge arises because services are often less tangible and easier for competitors to replicate. For instance, in industries like real estate sales, where services are the core offering, the barriers to entry are often quite low. New entrants can easily rent a desk and join the MLS, essentially competing with established players.

3. The Hybrid Solution: However, it’s essential to note that some service companies have found ways to become more scalable. These businesses are often hybrids, meaning they incorporate proprietary processes, products, or trade secrets into their service offerings. This added layer of uniqueness can create a sustainable competitive advantage, making it harder for others to copy their services. H&R Block is an example of such a hybrid company. They provide systems for sales, tax preparation, and other benefits that enhance their services and deter individual tax preparers from easy competition.

4. Investor Attraction: Scaling a company often necessitates external capital, such as investments from venture capitalists or angel investors. For these investors to commit their resources, a company must demonstrate strong margins and a substantial market opportunity. Investors want to see robust metrics that project profitability, which instills confidence in the company’s ability to provide a substantial return on their investment.

5. Exit Strategies: Investors are not only interested in getting in but also getting out. Companies seeking external capital must be prepared to offer exit strategies. This can involve selling the company, going public through an IPO, executing a management buyout, or other transactions that provide investors with a liquidity event. Ensuring these options are feasible is crucial to attracting investors.

Scalability varies across different types of companies. Product companies often hold an advantage due to the tangibility of their offerings and the ability to create barriers to entry. Service companies face more challenges, but some can become more scalable by incorporating proprietary elements. Regardless of the type of business, attracting investors requires strong margins, a substantial market opportunity, and a clear path to exit strategies. Understanding these dynamics can help entrepreneurs make informed decisions about the scalability of their ventures.