“In business, the idea of measuring what you are doing, picking the measurements that count like customer satisfaction and performance… you thrive on that.” – Bill Gates

The Enigma of Pre-Money Valuation As an entrepreneur seeking outside investors, the term “pre-money valuation” often looms large. It’s the pivotal figure that can determine how much equity you’ll part with in exchange for the much-needed capital to fuel your startup’s growth and scaling. But what precisely is pre-money valuation, and how do investors arrive at this critical number?

Understanding pre-money valuation: pre-money valuation is, in essence, the estimated worth of your startup before any external investments are injected. It sets the stage for the equity stake investors will receive in return for their financial support. To decode how investors calculate this value, let’s delve into the key considerations.

“Your time is limited; don’t waste it living someone else’s life.” – Steve Jobs

1. The Core Idea and Market Potential: At the heart of pre-money valuation is your business idea. Investors scrutinize its uniqueness, feasibility, and growth potential. Is your idea a game-changer in the market, poised for substantial expansion? The more promising the concept, the higher the pre-money valuation tends to be.

2. Market Research and Competitive Analysis: Extensive market research and a comprehensive competitive analysis play pivotal roles. Investors assess whether you understand your target market, its dynamics, and your competition. A well-defined strategy backed by robust research can elevate your pre-money valuation.

“The only strategy that is guaranteed to fail is not taking risks.” – Mark Zuckerberg

3. Growth Projections and Scalability: Growth is the cornerstone of any startup’s valuation. Investors closely examine your growth projections, aiming to gauge the potential returns on their investment. The scalability of your business model is equally crucial. Can your startup expand rapidly and efficiently? A scalable model often translates to a higher pre-money valuation.

4. Market Size and Revenue Potential: Investors venture into uncharted waters armed with data. They scrutinize the market size and the revenue potential your startup can tap into. A larger market with substantial growth prospects can justify a more favorable pre-money valuation.

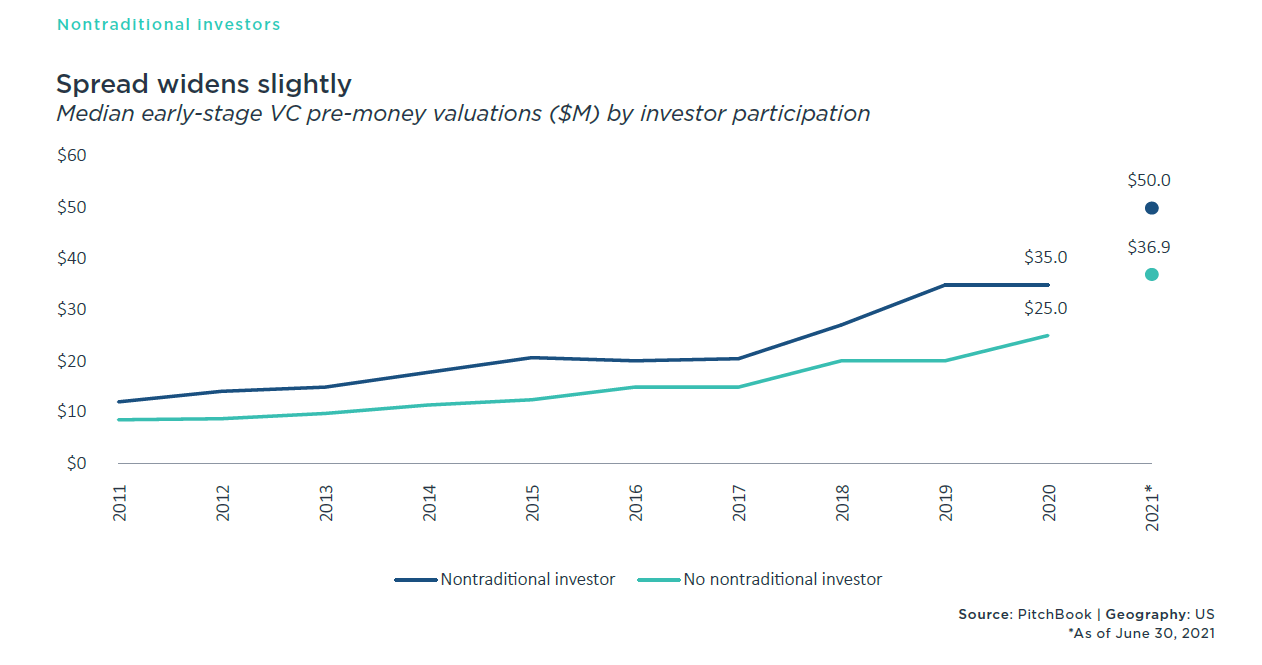

Here is a graph showing the deals reported to Pitch deck, which could easily be skewed very high by all the smaller deals that go unreported

“Don’t aim for success if you want it; just do what you love and believe in, and it will come naturally.” – David Frost

5. Team Expertise and Execution: The team behind the startup is a significant determinant. Investors assess the expertise, experience, and track record of your team members. Have they successfully executed similar ventures in the past? A seasoned team can boost your pre-money valuation.

6. Proof of Concept and Traction: Tangible proof of concept and early traction can be potent catalysts. Investors seek evidence that your business model works and resonates with customers. Positive traction can elevate your startup’s pre-money valuation.

“A business has to be involving; it has to be fun, and it has to exercise your creative instincts.” – Richard Branson

The Art of Valuation: Valuation in the startup realm is not an exact science but rather an art. It’s the delicate balance between a compelling idea, a stellar team, and a strategic plan for growth. Pre-money valuation is the nexus where your entrepreneurial vision meets investor expectations. As you tread this path, remember that investors seek not only financial returns, but also the promise of a venture poised for growth and scaling. Your valuation isn’t just a number; it’s a reflection of your startup’s potential to shape the future.