Venturing into the startup realm is an exhilarating journey that demands careful consideration of funding options. Contrary to popular belief, securing outside investments is not the starting point. Serious investors require a robust team, detailed plans, and a tangible product—a Minimum Viable Product (MVP) or prototype. It’s a misconception that headlines of million-dollar investments magically happen without laying the groundwork. In reality, such success often comes after initial self-funding to prove the concept.

“Value is created when you build these components. Then the stock is worth something.” – Unknown

The Harsh Reality of Startup Failure: The startup landscape is strewn with remnants of businesses that failed to understand the complexities involved. Shockingly, over 80% of startups crumble because founders underestimate the multifaceted skills and the experienced team required. Building a scalable startup demands about 40 skill sets, usually necessitating a seasoned team to launch successfully. The notion of a college graduate single-handedly creating a $100M startup is more myth than reality, perpetuated by sensationalized headlines.

Bootstrapping: A Strategic Move: Bootstrapping, or self-funding, becomes a necessity as entrepreneurs navigate the initial stages using personal, co-founder, and friends-and-family funds. This self-reliance is crucial to completing the foundational steps of team building, strategic planning, and MVP development. Investors, after all, are purchasing stock, and the idea alone holds no intrinsic value. The fallacy that an idea is “worth millions” is dispelled; true worth materializes when essential components are in place.

Navigating the pre-money valuation landscape: The journey into the realm of valuation begins with a “pre-money valuation,” a pivotal metric that determines the initial worth of a startup before external investments. This figure can vary significantly, from being modest to reaching $5M, depending on multiple factors. The percentage of the company allocated to seed investors hinges on the actual equity value created. Strategic bootstrapping extends this initial phase, reducing the equity required when external investors enter the scene. Many of the world’s billionaires, in fact, delayed seeking outside capital, choosing to bootstrap and retain a more substantial ownership stake in their ventures.

“Smart founders bootstrap longer with sweat equity and personal and family funds to drive the valuation further up before selling their first shares.” – Unknown

Sweat Equity and Strategic Stock Options: Wise founders extend their bootstrap phase by leveraging sweat equity and personal or family funds. This strategic move enhances the valuation of the startup, reducing the equity needed when shares are eventually sold to investors. Co-founders and employees often opt for stock as compensation or a lower salary in exchange for stock options. The potential for a 100% to 1,000% increase in share value within a year or two is a compelling reason. This approach ensures that those contributing to the startup’s success share in the prosperity that arises when the venture gains traction.

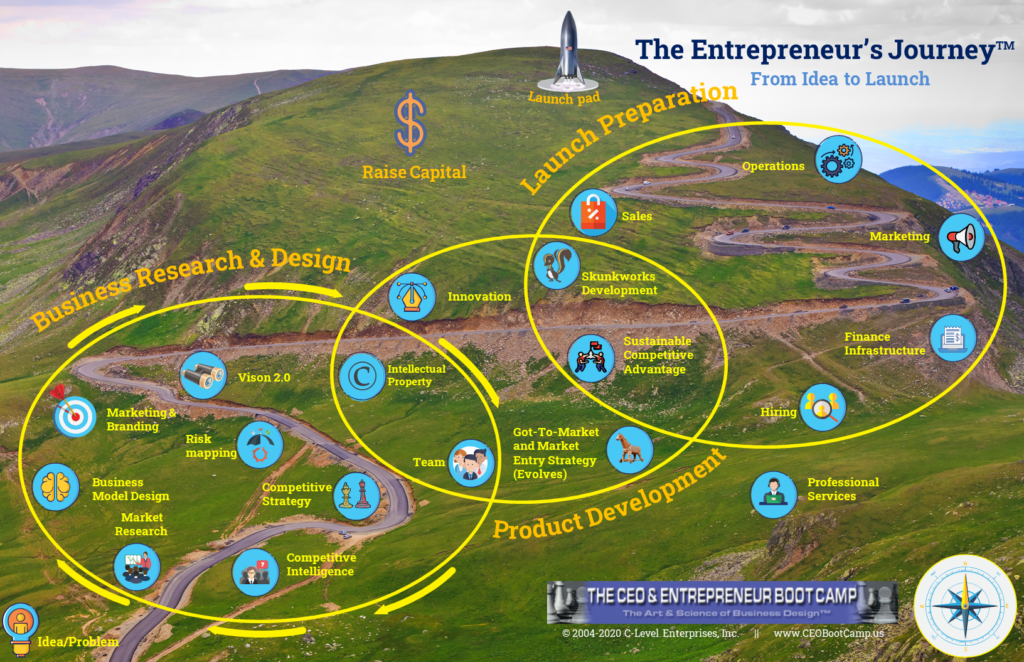

You can see my free course on the process of designing, building and launching a startup

“The further you get bootstrapping, the less equity you will need to give to investors.” – Unknown

Empowering Entrepreneurs: Empowering entrepreneurs with knowledge and insights is a crucial aspect of nurturing successful startups. Courses and webinars, like the ones offered by Bob Norton, a seasoned 6X founder with four exits over $1 billion, provide a roadmap for aspiring business leaders. The educational resources cover the intricate process of designing, building, and launching a startup, along with valuable insights into the intricate art of raising capital.

In the dynamic realm of startups, where every decision shapes the trajectory, understanding the power of bootstrapping is akin to possessing a compass. It enables entrepreneurs to chart a course that not only safeguards initial ownership but also strategically positions the startup for future success and sustainable growth.

We also have a webinar on raising capital here: https://ceobootcamp.us/capital