Unlock Exponential Growth: Proven Strategies for Scaling Any Fintech, Crypto, Blockchain or Digital Payment Business

FACT: 99.98% of Companies Never Reach $100M—Will Yours Be Different?

Scaling Your FinTech Company is Hard—Failing is Harder. Here’s What’s Stopping You.

You Built a Great Fintech Company—So Why Aren’t You Scaling Faster?

Most CEOs of Technology Companies Hit a Growth Ceiling—Here’s How to Break Through

You’ve built a company that solves a real problem. You have customers. Your revenue is growing—just not fast enough. And FinTech has the ability to scale operationally; marketing and partnerships are often the bigger challenge.

If you’re like most CEOs, you’re working harder than ever, but the business isn’t scaling as expected. You’re not alone. Only 1 in 6,300 companies will ever reach $100M in revenue—and only 1 in 400 companies will reach just $10M—not because their product isn’t good enough but because they hit roadblocks that keep them from growing. Because they must shift management styles and gears at each new level. And use more sophisticated leadership systems.

FinTech, crypto, digital payments, and blockchain are all a game of scale. Reaching critical mass when the network effect kicks in and your trajectory skyrockets. Few will make it because the differentiation and value added must be greater than competitors, and the marketing must be excellent too.

The good news? These roadblocks are predictable—and fixable.

Does Any of This Sound Familiar?

- Growth Has Stalled—Your revenue plateaued despite having product-market fit. You have not reached the proverbial hockey stick curve that allows rapid growth.

- Scaling Feels Chaotic: You’ve hired people, but execution is inconsistent.

- You’re Stuck in the Weeds: Your leadership team spends too much time fighting fires instead of scaling.

- Customer acquisition is not predictable—sales and marketing aren’t driving consistent results. You need a repeatable economic formula.

- Visibility to Profitability Isn’t Clear—Revenue is up, but fixed costs are high and climbing with marketing expenses and staff.

- You’re constantly fixing mistakes; your team makes avoidable errors that cost time and money.

- Hiring great people is hard—finding and keeping A-players feels like an endless challenge.

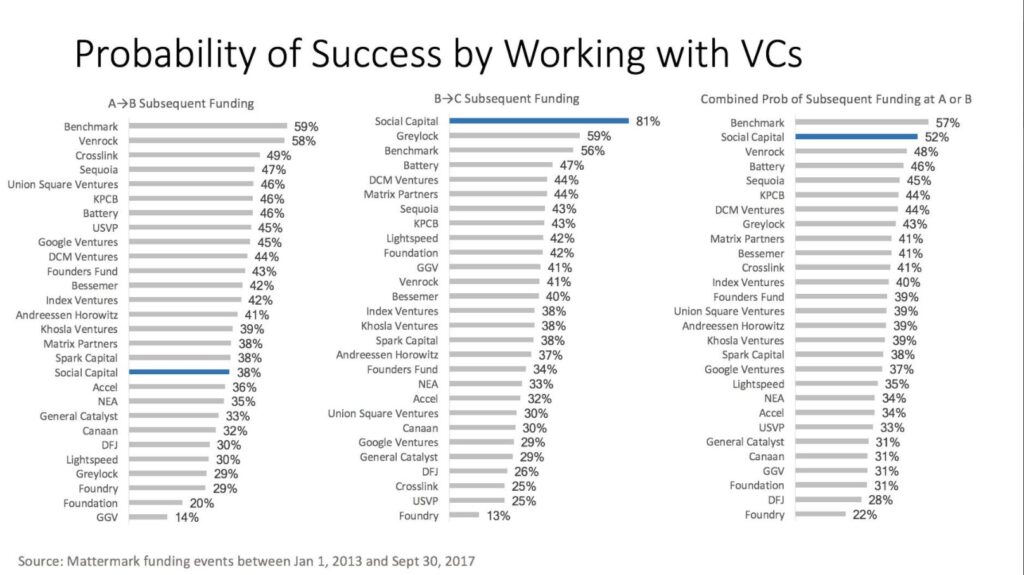

- Investors Aren’t Biting You need funding to grow, but you’re not getting the valuations you need.

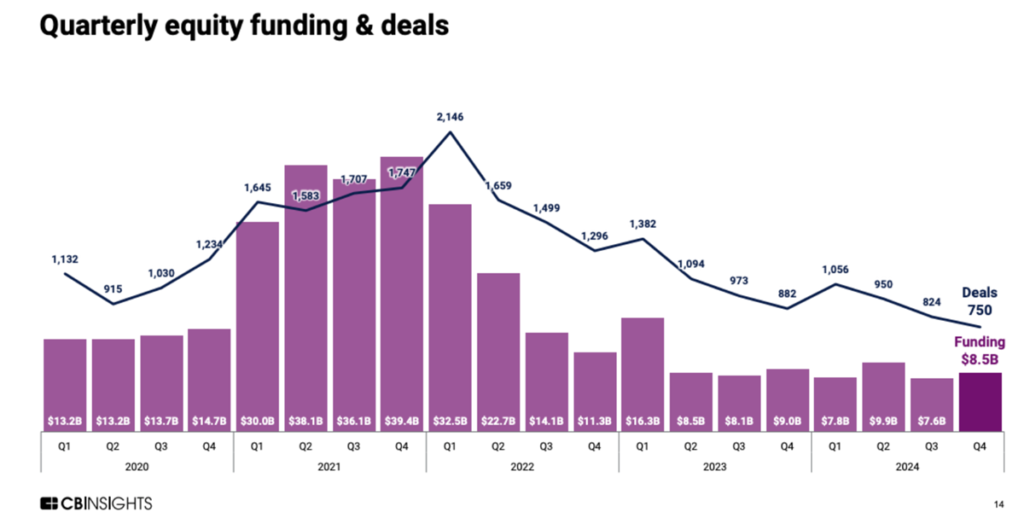

Despite this decline in funding levels, median deal size for fintech companies increased by 33% to $4 million. Fintech companies completed 73 mega-rounds, raising $12 billion through rounds that raised over $100 million. Globally, there were 14 fintech unicorn “births,” bringing the total number of fintech companies valued at over $1 billion to 326. The report notes that there were a total of 664 M&A exits in 2024, a 6% jump year-over-year. IPO activity remained relatively tame, with 28 IPOs completed, while only three fintech companies completed a de-SPAC transaction. – CBINSIGHTS

Benefits that we can guarantee, like no one else globally:

Achieve Rapid Growth: Our tailored strategies ensure entry into new markets, increasing your TAM and ability to raise capital too, minimizing time to revenue.

Mitigate Scaling Risks: We identify and address all common pitfalls in scaling, safeguarding your company’s resources and reputation. Our systems and IP get you to the next level in weeks, not years

Maximize Operational Efficiency: Systematize all processes to enhance productivity, leading to sustainable growth.

- We target 50%+ CAGR and a 2X to 6X valuation in one year by using several little-known techniques. This translates to 32X in five years—it’s just math—easy to say but hard to do. Of course, more is possible with conditions right.

This is only possible because we have invested decades in the art of scaling and millions in our intellectual property, training platform, and systems. And have deep experience in FinTech, blockchain, and crypto.

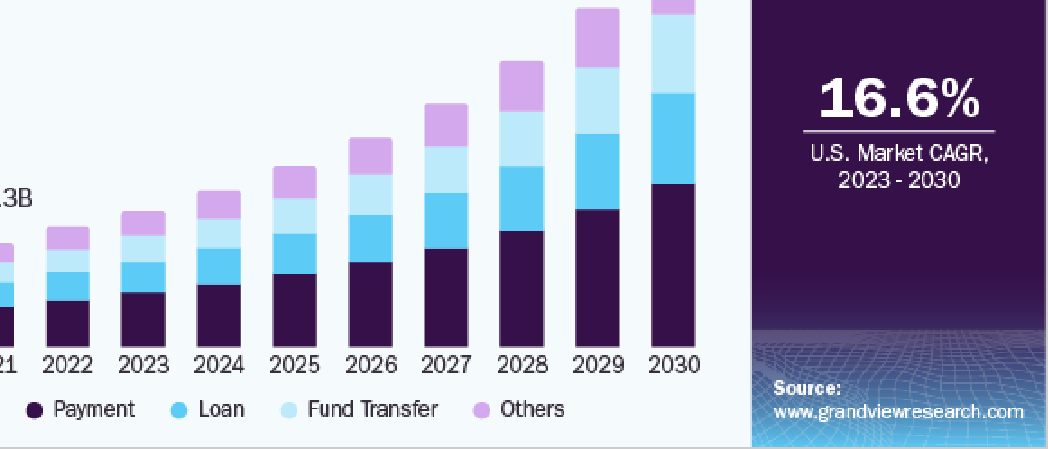

One of the primary drivers in FinTech and crypto is the increasing demand for seamless, user-friendly digital financial services among consumers and businesses.

Traditional financial institutions are recognizing the need to enhance their offerings to meet evolving customer expectations, leading them to partner with Fintech-as-a-Service (FaaS) providers to integrate advanced technological solutions into their operations. — Grandview Research

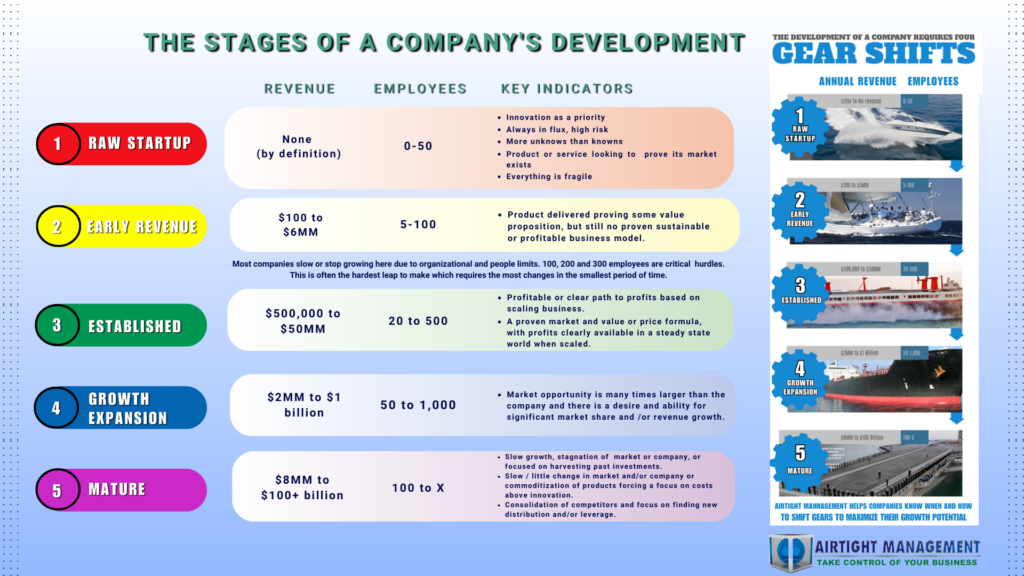

Scaling Requires Shifting Management Style and Systems at Each Level

Every company, even in FinTech, needs to completely adjust their management style and systems and reorganize at each of the five levels shown at left. Few people have done this well multiple times like our founder

Founding teams need to fill out the senior team and tap into expertise they may not be able to afford full-time by using fractional CXOs, consultants, and other trusted advisers that have scaled to that next target revenue level.

And scaling requires more capital at much higher prices to retain fair ownership levels and accelerate growth. We target 50% CAGR to 100% for most clients. Even higher growth rates are possible in FinTech once critical mass is reached.

If these challenges sound familiar, you don’t need more hustle—you need proven systems for scaling.

You need to develop and add to your team, adapt your organization’s structure, and get guidance from a scaling expert at each stage transition.

FinTech, Crypto, Digital Payments, and Blockchain all have the advantage of digital businesses, and so scaling operations is not the hardest part. However, scaling people, marketing, security, and asset management has all the same problems.

The Path to Breakthrough Growth is Proven—We have already helped over 200 companies scale (see below)

Why Some Companies Scale—And Others Stall

Most high-tech businesses struggle to scale, not because of their product but because their business operations are not designed for rapid growth. Their teams are incomplete or inexperienced at scaling. And because they lack the fractional CXOs, advisers, and consultants that could cut through problems easily.

Young companies often try to “reinvent the wheel.”. They falsely believe their company is unique, and they need to reinvent management and leadership systems and science that are standard in any industry at the strategic level to create high-performance cultures and companies.

Most fail to use many decades of management science and leadership practices that are well proven but unknown to most—and not even taught in the top MBA university programs. We have been curating and organizing these for two decades.

We work with tech CEOs to install Airtight Management—a proprietary, battle-tested system that enables your company to scale faster, smoother, and with higher profitability.

What Happens When You Remove the Hidden Bottlenecks?

✅ Revenue Growth Accelerates: Get the right systems, strategy, and people in place to scale consistently. Easy to say. Very, very, hard to do.

✅ Operations Run Smoother: Eliminate chaos with structured processes that let your team execute flawlessly.

✅ Your Leadership Team Becomes High-Performing: Build an accountable, execution-focused leadership team that drives results.

✅ Sales & Marketing Become Predictable: Generate and convert more leads with a scalable go-to-market system.

✅ Profitability Increases: Stop losing money due to inefficiencies, execution errors, and hiring mistakes.

✅ Your Valuation Skyrockets Become investor-ready with a business model that justifies higher multiples.scale

Top 3 Systems Needed

The CEOs We Work With See Results—Fast.

We’ve helped hundreds of software and high-tech CEOs in over forty industries transform their companies with a proven system for scaling. And at The CEO Boot Camp since 2004. Although many clients do not want their competitors to know about us, see selected quotes below. And video testimonials on our home page. Here’s what some of them have said:

“Using the systems we learned, we immediately solved problems we had struggled with for years after only two days working with Bob Norton.” – Software firm

“We were stuck at four locations and constantly fighting fires. After installing AirTight Management, we began growing steadily every year and reached a dozen locations, getting a $60 million buyout offer from a private equity firm.” – Medical Clinic, CEO

“Before we implemented AirTight Management, we were constantly playing defense. Now we have a scalable growth engine, and our revenue is compounding. We went from $20M to $72M in three years.”

“Our culture was more productive after only sixty days. After implementing AirTight, our leadership team took ownership, and we grew steadily every month. And as CEO, I got out of the weeds. We have 10Xed our growth expectations now.”

Book a Call—Let’s Identify Your Growth Roadblocks

You don’t need another generic business consultant. You need a scaling framework with systems designed specifically for high-growth tech companies.

On this call, we’ll:

- Identify your biggest growth bottlenecks

- Pinpoint where your operations are holding you back

- Outline the next steps to fix them—fast

This is a zero-pressure call. If we’re not a fit, we’ll tell you. But if we are, this could be the single most valuable conversation you have all year. It could literally add $10M+ to your valuation in a year and enable faster growth with a higher valuation multiple too.

📅 Schedule a call now. Let’s start scaling.

Running a business is easy!

Growing a business is not!

Call to get industry-specific case studies.

Or Call (619) SCALE06, (619) 722-5306 from 9am to 6pm CT.

This is not a sales call but an assessment of your company’s ability to scale and eligibility for our $10 million guarantee. In any event, we will guide you towards greater success. We will study your website and other materials in advance.

Past Clients We Have Helped