The Scaling Experts | Small Business Growth O/S

The Scaling Experts | Small Business Growth O/S

The best way to destroy your credibility with investors is to say we are going to attack, and own a multi-billion dollar market. Although this may intuitively seem to attract investors, in actuality it is a fatal mistake raising capital. Your credibility using $100B or $1 trillion markets is shot to hell. Here is why.

No startup should be going after a market larger than $1B five years out. An ideal market niche size is between $100M and $250M. Niching down is not optional. It is basically suicide to tackle huge markets. Even better is a series of niches in a portfolio of markets shown below.

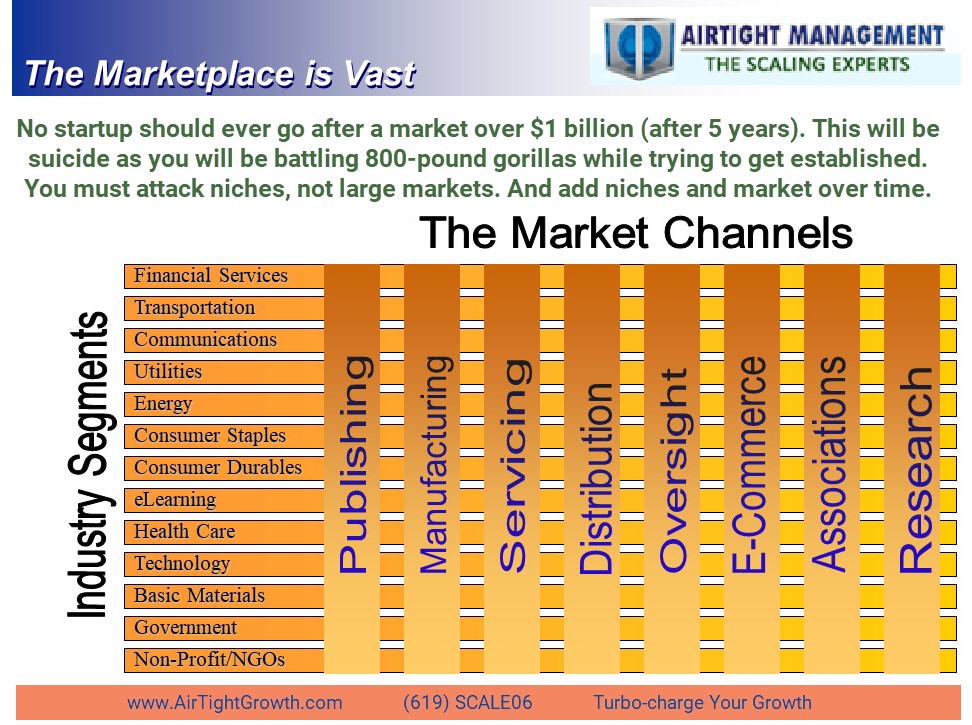

I have often done with 100% success a “Portfolio of niches” strategy for market entry. This means laying out and ranking many niches and them prioritizing them by various factors. And it sets you up to be very agile too. The product roadmap and target niches expand each year, as shown below. The first chart shows the long-term market potential for a horizonal product or services with 104 market niches in this case. That can be billions because you are not going after it all at once as a tiny company.

This example niche matrix shows the industries and application (also called channels here) of the software to create and prioritize niches. Where you will have little to no competition. Raw startups should ideally have literally zero competitors in a niche market by having high differentiation. This greatly focuses and reduces marketing and sales costs.

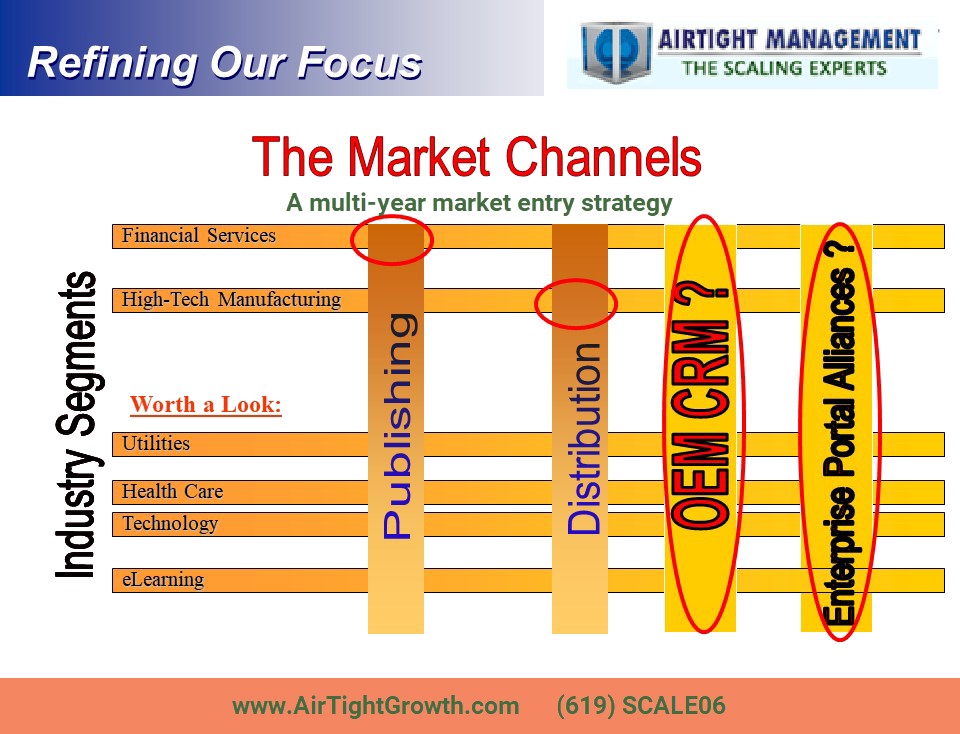

Now look at a true “Market Entry Strategy” over 4-5 years. This is not the same as the Go To Market (GTM) strategy, which is just the first niche in year one. Here the two red circles are niches for years #1 and #2 (flexible), prioritized by the pain level, price sensitivity and other factors researched in the market. The top left red circle was a smaller market of maybe $80M. However, you can customize and go deep with those customers and validate your technology, sales process, and many other things without lots of competition.

Then each niche gets bigger in successive years showing investors the total potential markets, without competing with Microsoft, Oracle, Apple and 10,000 other large companies. This market entry was for a software product that collected and distributed unstructured content and so it had many applications and markets because it was well designed. This flexibility can multiply a startup’s chances of survival.

This shows a gradual expansion of the targeted niche markets as you establish cash-flow, higher stock price and financing and validate your technology, internal systems and sales and marketing. Reducing risk in these small markets will skyrocket your stock price to raise cheaper funds and expand the number of potential investors vastly. This shows a 5-year plan to enter 2 niches (years 1 and 2), then larger markets (in this case selling through partners) that are in the two larger red ovals.

This is a key concept that most entrepreneurs fail to get because they want to brag about HUGE markets.

It is suicide, with very, very rare exceptions, to go after huge markets on market entry if you are a startup. This is all ego and not smart for founders to try to sell to investors. It screams “I am an amateur and will be pouring your money down the drain.” Anyone doing this will drive away the best investors immediately. Investors call this “Boiling the ocean”. Something investors have gotten burned on for many decades and know very well.

I find most startup companies greatly underestimate this need to niche down their offering to smaller markets to be a larger fish in a smaller pond. This is forced, not by the product or services capabilities, but by the nature and cost of marketing today. Especially online marketing that is keyword focused. Marketing channels are fragmented and yes a startup you can only use a very limited number.

The old saw “Marketing to everyone is marketing to no pone” comes to mind here.

Startups must start with bite-size niches. Saleforce.com started with mobile salespeople by advertising in airports.

Facebook with colleges. Apple with home computer builders, then graphics and schools.

Startups going after $1B+ markets will be competing with 800-pound gorillas. And that’s not a good place to be without lots of staff, resources and solid systems that Jim Colins in Good To Great says the average great company he studied took eight to ten years to develop.

Entrepreneurs not doing this are first timers, amateurs. They will either adjust rapidly or fail and likely not even raise capital because this is such a blaring error.

Even General Motors niches every vehicle to a narrow demographic market. Because marketing requires it.

What does the operator say when you call up GM and ask for the Vice President in charge of headrests?

Driver side or passenger side? ;0) Yes, that’s specialization.

EVERYONE MUST NICHE TODAY. NO EXCEPTIONS UNTIL YOU HAVE HUGE REVENUE. This has been true for at least decades now. And is it not likely to change.

Bob Norton is a long-time Serial Entrepreneur, CEO and investor who founded six companies with four exits that returned over $1 billion to investors for a 25X ROI. Two others are still in development. He has trained, consulted and advised thousands of Entrepreneurs, CEOs and boards since 2002. Mr. Norton works with companies to 2X to 10X growth rates and valuation using AirTight Management™, the world’s most comprehensive Leadership Operating System. He also helps companies raise capital to fund growth. He is also the Founder of The CEO Boot Camp™ and Entrepreneurship University™ for early-stage companies that have not reached product-market fit and $1M ARR.

What can we help you with today? Scaling, training, consulting, coaching?

Call (619) SCALE06 or (619) 722-5306 9am-6pm CT

Or Schedule a free 30-minute strategy session by clicking here.