Raising Capital From Investors to Finance a Company's Startup and Growth

Companies need investors to start and grow. The more successful they are the more capital they need.

Finance includes many skills a company needs to raise capital, perform accounting, file taxes and budget and plan. We have several courses on finance and financing strategy available at www.EntrepreneurshipU.com

See below for our free and low cost course on raising capital from over 40 different sources.

Financing and Raising Capital

Rasing capital is complex and there are literally dozens of types of financing and deal structures that include: debt. equity, royalty, private, public, venture capital (VC), family offices, private equity firms (PE) angel investors and many others.

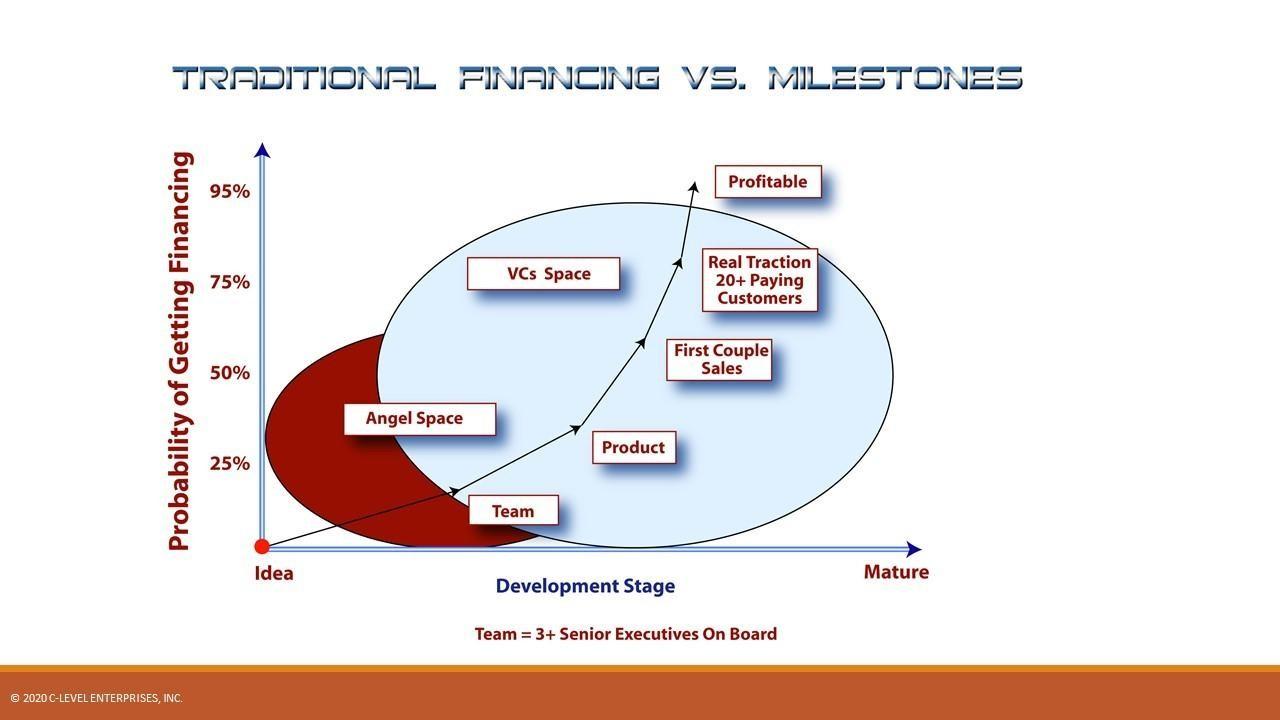

This chart shows just a few of the most popular financing sources as a company is founded as a startup and begins to grow. After reaching profitability and scale a company has many more options like bank financing, IPO, private equity investors and creating their own bonds (“paper”) to sell which can take many forms too. Of course, there are many more sources of capital like government source.

Top 8 Reasons Startups and New Products Fail

What Most Entrepreneurs Do Not know they need to work on BEFORE attempting to raise funds, or do anything else.

By: Bob Norton LinkedIn

Entrepreneurship and tools for it have exploded in recent years. You could even say most anyone thinks they can be an entrepreneur. Of course, more than 80% of new businesses still fail within five years. Mainly because people greatly underestimate the skills and effort needed to create a new business or model. For the purposes of this article I am defining Entrepreneurship as only doing something brand new. It is not starting another dry cleaner, franchise or restaurant unless there is something very different about the business model. Of course, some people will make money with a good recipe and excellent execution, it is just not a business that can attract risk capital for growth until after it is financially proven.

Many newbie or wannabe Entrepreneurs think the first step is to develop a “pitch deck” to raise funds but this is backwards thinking. A pitch deck can only be developed with a series of other underlying work done first. I get requests to develop pitch decks almost every week and see many online requests that have a budget of $500 or less. Some I talk to really want you to develop their entire business model and plan and have nothing but an idea. Often a bad one. They have not even done the basic market research or competitive intelligence. They have no real business model design and, even worse, often no real experience or team with the right skills to validate the business can work. This is folly. They just have an idea.

Ideas are literally worthless. Even a patent (an idea you “own” exclusively) might only get 2% to 5% of the revenue to build and sell that product or service based on the patent. So, expecting anyone to turn your idea into a business model and deck for you that will raise funds is usually lunacy, unless you want to spend tens of thousands of dollars to hire a team of people in marketing, sales, management and more. Of course, there are those that will be happy to take your money and tell you they can. And those that will believe them and lose their shirting working for literally years on a bad plan created by a writer, consultant or contractor, not a CEO or experience businessperson.

A pitch deck is the result of many skill sets integrated. It must deal with strategies for marketing, sales, product/service development, finance and operations at a minimum. All art forms at the strategic level requiring at least ten years’ experience in that art. The deck/plan requires input from highly experienced people in all these areas and usually weeks, or even months, of market research, competitive intelligence and far more. This can usually be done alone only by a highly experienced CEO (10+ years in that role), or alternatively, by several experience people with different skills sets in marketing, innovation, sales and finance. Or by consultants with 15+ years’ experience in each of the key areas.

One person must have experience running a significant business (50+ employees ideally) for at least 10 years. This is a very rare Consultant. Most are very narrow specialists in a technical area. I would guess only 1% to 2% have the scope and business experience to do a deck or plan without the help of other experts.

Buying template pitches and business plans is a recipe for failure because if your business is not differentiated you should not be doing it. Unless maybe it is just a local retail or service business serving an area without any competitors. And that is a hard business to attract capital for except for personal loans or after you are already profitable. Not real entrepreneurship as defined here.

Learn how the top 5% of Entrepreneurs succeed at getting outside investors.

This virtual training is designed to be an unforgettable and transformative experience. It will set you up for success and help you develop a multi-year financing strategy that attracts the best investors, gets you a much higher valuation, and improves your business along the way. And attract better cofounders and team members. It could easily be worth millions to you.

Raising funds from outside investors is hard. But like so many other things there are many secrets few know and share.

Don’t let the daily headlines fool you. Each type of investor, angel, professional VC, family offices, corporate funds and many other sources have a distinct set of needs and expectations for their portfolio companies. You need to customize and present for each differently.

Many believe it is a numbers game all about introductions and pitches. It is not. Would you sell a beat-up car by doing more sales pitches? Not likely. You would need to improve the car some, lower the price or go to a junkyard. Same goes for raising capital.

What you get:

- Learn the strategies that top entrepreneurs have used to raise billions in capital. 90% seeking funds will not get outside investors. Understanding why they failed will ensure you are not wasting your time.

- Learn to target the best investors for your situation and what they need to see and hear to get excited about your deal in your pitch.

- Learn what team quality level you need at each level of investment targeted – An objective test.

- Learn how to find and approach the right investors. There are many false beliefs about this that can prevent you from being successful.

- See examples of the best pitch deck slides that will make you stand out from the rest.

- Learn how to get the highest valuation possible, so the Founders do not end up owning less than 20% when you exit. This can translate into millions more for your founding team.

- FREE BONUS: A toolkit with 25 different files including a convertible note to take money from angel investors, a dozen articles on different categories of investors you need to understand, a sample financial model like what investors what to see, and some famous pitch decks including Airbnb and others, and many more. These could save you time and thousands of dollars in legal fees and problems.

Click here to register for this free course and find other resources for raising capital for small businesses.

Most people seek capital too early when they are not yet an attractive investment. Contrary to popular belief your idea is worth exactly zero dollars! Even a patent on a process has limited value compared to the team and other factors.

Investors seek to invest based on a “Pre-money valuation”. Which means equity value has already been built with team, plans, product and more.

This course will allow you to rate your readiness and also generate the list of things you must do to become financeable.